Best Crypto Exchanges In Canada 2025

Last Updated: November 2025

Finding the best crypto exchange in Canada depends on safety, fees, features, and how easily you can move money in and out using CAD. This guide compares the top platforms for different needs, giving a clear breakdown of costs, security, and overall usability.

Quick Facts:

- 5 leading Canadian crypto exchanges reviewed

- Interac e-Transfer supported on most platforms

- All exchanges comply with Canadian regulations

- Trading fees range from very low (NDAX) to medium (Coinbase)

- Updated November 2025 with latest fee structures

Jerry Dennis

Founder & Lead Blockchain StrategistJerry Dennis is a visionary founder bridging traditional technology and decentralized finance. With over 15 years in software development and SaaS innovation, he brings deep expertise in creating scalable blockchain solutions and crypto-investment strategies. His passion lies in demystifying complex concepts and making advanced technology accessible.

View full author profile →

Samantha Lee

Co-founder & Chief Technology OfficerCo-founding Best3iGaming alongside Jerry, Samantha Lee serves as the architect of the platform's security infrastructure. Her expertise in software engineering and cybersecurity ensures every digital transaction is handled with maximum safety and efficiency. She believes the future of decentralized technology must be inherently trustworthy and secure.

View full author profile →

Markus Webb

Head of Research & DevelopmentMarkus Webb brings over a decade of experience in blockchain technology and digital currency research. He specializes in turning complex cryptographic concepts into practical financial solutions. His work focuses on analyzing blockchain applications and understanding the implications of cryptocurrency investments for the future of economic systems.

View full author profile →Marcus Whitfield

Chief Editor, Best 3 iGamesMarcus Whitfield is a financial technology analyst and iGaming specialist with over 8 years of experience covering online trading platforms, cryptocurrency exchanges, and regulated gambling markets. After beginning his career in compliance consulting for UK fintech startups, Marcus transitioned to financial journalism, focusing on helping everyday investors navigate complex platforms.

He holds a certificate in Financial Services Regulation from the Chartered Institute for Securities & Investment (CISI) and has contributed research to publications covering emerging markets and digital assets. When not analysing broker fee structures, Marcus can be found testing new trading apps or following Premier League football.

He has worked with iGaming operators across multiple jurisdictions on licensing requirements, anti-money laundering protocols, and the implementation of provably fair gaming systems. His particular focus is on helping platforms navigate the complex regulatory landscape where cryptocurrency and online gambling intersect.

Douglas Harbury

Blockchain Strategist & iGaming Compliance ConsultantDouglas Harbury is a blockchain strategist and iGaming compliance consultant with over 18 years of experience across digital payments, cryptocurrency infrastructure, and regulated online gambling markets. After spending the early part of his career in payment processing and financial operations, Douglas moved into emerging financial technologies in 2011, advising cryptocurrency exchanges and digital asset platforms on regulatory frameworks and operational security.

He has worked with iGaming operators across multiple jurisdictions on licensing requirements, anti-money laundering protocols, and the implementation of provably fair gaming systems. His particular focus is on helping platforms navigate the complex regulatory landscape where cryptocurrency and online gambling intersect.

View full author profile →How We Test & Review

At Best3iGaming, we maintain rigorous standards for all blockchain and cryptocurrency content through comprehensive testing and verification. We do not accept payment in exchange for positive reviews.

- Direct Testing: We open real accounts, deposit real funds, and play games to test the user experience.

- Withdrawal Verification: We test withdrawal speeds and KYC requirements personally.

- On-Chain Verification: We cross-reference transaction claims with blockchain explorers.

- Expert Review: All content is reviewed by experienced blockchain professionals before publication.

- All claims backed by multiple authoritative sources.

- Clear disclosure of any affiliate relationships.

- Independence maintained in all editorial decisions.

Report inaccuracies: contact@best3igaming.io

Best B3i Gaming Disclaimer

Best B3i Gaming is an affiliate website. We may receive commission from casinos, gambling platforms, and other services featured on this site when you click through our links and register or deposit. This comes at no additional cost to you.

Our affiliate relationships may influence which platforms we review, how they are rated, and where they appear on our site. However, we strive to provide honest, balanced assessments to help you make informed decisions.

You are solely responsible for conducting your own due diligence before using any platform, service, or product featured on this site. This includes, but is not limited to:

- Verifying that online gambling is legal in your country, state, territory, or region.

- Confirming that any platform you access is licensed to operate in your jurisdiction.

- Understanding the terms, conditions, and risks associated with any platform before registering or depositing.

- Ensuring compliance with all applicable local, national, and international laws.

- Assessing your own financial situation and risk tolerance before gambling or using cryptocurrency.

Best B3i Gaming does not and cannot verify your location, age, or legal eligibility to gamble.

We do not endorse, guarantee, or verify the licensing status, legitimacy, security, or fairness of any platform featured on this site. You must independently verify a platform's regulatory status and reputation before use.

A platform's inclusion on this site does not constitute a recommendation that it is legal, safe, or appropriate for you.

Nothing on Best B3i Gaming constitutes financial, investment, legal, or tax advice. We are not licensed financial advisors, solicitors, or tax professionals.

Cryptocurrency values are highly volatile; you may lose some or all of your funds. Any information regarding cryptocurrencies, tokens, or digital assets is for informational and entertainment purposes only.

Gambling involves significant risk. You may lose more than you deposit. Only gamble with money you can afford to lose.

Past results, promotional offers, and theoretical return-to-player (RTP) percentages do not guarantee future outcomes. Casino games and betting products are designed to favour the operator over time. There is no guaranteed strategy for profit.

Gambling should be entertainment, not a source of income or a way to recover losses. If you or someone you know is struggling with problem gambling, please seek help from a recognised support organisation in your region:

- BeGambleAware (UK): begambleaware.org

- GamCare (UK): gamcare.org.uk

- Gambling Therapy (Int): gamblingtherapy.org

- NCPG (USA): ncpgambling.org

- Gambling Help Online (Aus): gamblinghelponline.org.au

You must meet the minimum legal gambling age in your jurisdiction to use gambling services. This is typically 18 or 21 years of age depending on location.

By using this site, you confirm that you meet the legal age requirement where you reside. It is your responsibility to know and comply with age restrictions in your area.

Information on Best B3i Gaming is provided "as is". We do not warrant that any information is accurate, complete, current, or error-free.

Platform terms, bonus offers, wagering requirements, accepted cryptocurrencies, withdrawal limits, licensing status, and features may change at any time without notice. Always verify current terms directly with the platform before participating.

To the fullest extent permitted by applicable law, Best B3i Gaming, its owners, operators, employees, contractors, and affiliates accept no liability whatsoever for any loss, damage, cost, or harm arising from:

- Your use of this website.

- Reliance on information provided here.

- Use of third-party platforms.

- Any decision made based on this content.

- Gambling or crypto losses.

- Legal consequences of your activities.

Indemnification: By using this site, you agree to indemnify and hold harmless Best B3i Gaming and its affiliates from any claims arising from your use of this site or third-party platforms.

Third-Party Links: We have no control over third-party websites. Accessing external links is entirely at your own risk. Changes: We reserve the right to update or modify this disclaimer at any time without prior notice.

Quick Verdict: Top 3 Crypto Exchanges in Canada (2025)

Our top recommendations for simplicity, low fees, and Canadian regulation.

Top Pick

Low Fees

Canadian-First

Quick Comparison: Top 5 Canadian Crypto Exchanges

| Exchange | Best For | Trading Fees | Min Deposit | CAD Funding | Coins |

|---|---|---|---|---|---|

| Coinbase | Beginners | Medium | No minimum | Interac | Popular majors |

| Kraken | Active traders | Low | 10 CAD | Bank transfer | Widest range |

| Bitbuy | Regulated users | Medium | No minimum | Interac | Major coins |

| NDAX | Low cost | Very low | No minimum | Interac | Large range |

| Wealthsimple | Simple investing | Low | 1 CAD | Interac | Limited majors |

What Is the Difference Between Maker and Taker Fees?

Maker fees apply when you place an order that adds liquidity, while taker fees apply when your order fills instantly. Maker fees are usually lower because they help improve market depth. Active Canadian traders generally benefit most from exchanges with competitive maker-taker pricing.

Are There Hidden Fees on Canadian Exchanges?

Some exchanges include spreads inside quoted prices, meaning the fee is not shown separately. Others charge for withdrawals, funding, or certain order types. Canadians should check total effective cost—spread, trading fee, and transfer fee—to understand what they will actually pay.

Which Exchange Has the Lowest Fees in Canada?

Kraken and NDAX consistently offer Canada's lowest overall trading costs, especially for active or high-volume users. Their fee structures remain competitive with tight spreads and predictable maker-taker pricing. For more options, check our guide to lowest fee crypto exchanges.

Top 5 Best Crypto Exchanges in Canada

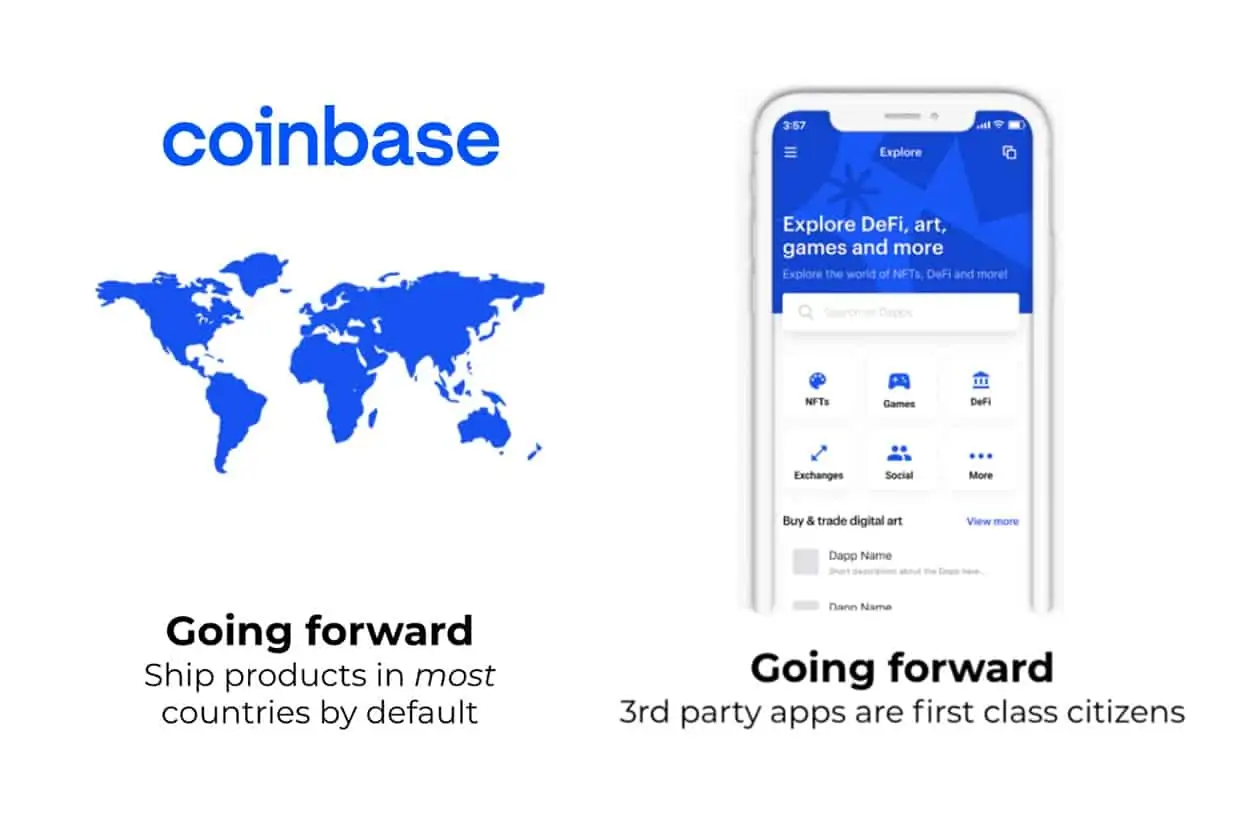

#1 Coinbase – Best for beginners

What are the Pros & Cons?

Coinbase is ideal for newcomers who want a simple layout and strong security. Its fees are higher than trading-focused platforms, but the overall experience feels smooth and predictable.

✓ Pros

- Easy interface

- Strong security

- Good CAD support

✗ Cons

- Higher fees

- Fewer advanced tools

Who Is Best For?

Coinbase suits beginners who want a straightforward experience and don't mind paying slightly higher fees for simplicity and safety. It also works well for long-term investors who prefer a stable, regulated environment without complex trading interfaces.

What are the Fees?

Coinbase uses a variable fee model based on spread and transaction type. While not the cheapest option, pricing is transparent and predictable for Canadians funding through Interac or card-based methods. Active traders typically find cheaper alternatives on Kraken or NDAX.

What Cryptocurrencies are Available?

Coinbase supports a wide selection of major cryptocurrencies, offering reliable access to Bitcoin, Ethereum, Solana, and many popular altcoins. Availability is curated for regulatory compliance, which keeps the list stable and avoids low-quality speculative tokens.

How Safe Is the Exchange?

Coinbase is regarded as one of the most secure exchanges globally. It uses cold storage for most assets, strong authentication options, and clear operational controls. Its long track record and transparent regulatory posture make it a trusted choice for cautious Canadian investors.

#2 Kraken – Best for low-fee active traders

What are the Pros & Cons?

Kraken appeals to Canadians who want tight spreads, strong liquidity, and a professional interface. It is less beginner-friendly than Coinbase but stands out for active trading.

✓ Pros

- Low fees

- Deep liquidity

- Advanced tools

✗ Cons

- Less intuitive

- Fewer CAD funding options

Who Is Best For?

Kraken suits experienced traders who want low fees, fast execution, and strong market depth. It's ideal for those who value precision and performance over a beginner-style interface.

What are the Fees?

Kraken uses a maker-taker model that keeps fees low for frequent traders. Costs fall as your volume increases, making it attractive for active strategies. CAD deposits and withdrawals vary by method but remain competitive relative to other global exchanges.

What Cryptocurrencies are Available?

Kraken offers one of the widest asset ranges available to Canadians, including major coins and a curated list of altcoins. Some high-risk tokens are excluded for compliance reasons, but overall choice remains strong for diversified traders.

How Safe Is the Exchange?

Kraken has a reputation for top-tier security, using extensive cold storage, audited controls, and robust infrastructure. It has never experienced a major breach and remains a trusted platform for traders who prioritise operational resilience.

#3 Bitbuy – Best for Canadians who want full regulation

What are the Pros & Cons?

Bitbuy is designed for Canadians who want a domestically regulated platform with transparent fees and strong oversight. It offers a local feel and support Canadians often prefer.

✓ Pros

- FINTRAC-registered

- Clear fees

- Interac funding

✗ Cons

- Smaller asset list

- Fewer advanced tools

Who Is Best For?

Bitbuy is ideal for Canadians who want a regulated, Canada-first platform with clear fee structures and strong security. It suits users who prefer simplicity and verified compliance over advanced trading features.

What are the Fees?

Bitbuy charges straightforward transaction fees that are easy to understand. Trading costs are mid-range but predictable, which appeals to users who dislike variable spreads. Interac deposit fees depend on the funding method chosen.

What Cryptocurrencies are Available?

Bitbuy supports a focused range of major cryptocurrencies curated for regulatory clarity. While the list is smaller than global exchanges, it covers the assets most Canadians want, including Bitcoin, Ethereum, and several established altcoins.

How Safe Is the Exchange?

Bitbuy is fully regulated in Canada and adheres to stringent compliance standards. It uses cold storage through qualified custodians and undergoes regular security audits. This makes it a comfortable option for users who value oversight and domestic protections.

#4 NDAX – Best for low-cost, high-liquidity trading

What are the Pros & Cons?

NDAX offers strong liquidity, low trading fees, and easy CAD funding. It's suitable for users who want an efficient platform without complexity.

✓ Pros

- Very low fees

- Fast CAD transfers

- Strong liquidity

✗ Cons

- Not beginners' first choice

- Smaller feature set

Who Is Best For?

NDAX suits traders who want low fees, dependable liquidity, and straightforward CAD on-ramps. It's a strong match for cost-conscious users who still want a clean, stable platform.

What are the Fees?

NDAX uses a simple fee model with a low trading rate and transparent CAD deposit and withdrawal costs. Its pricing consistently ranks among Canada's cheapest, especially for high-volume users or those regularly moving funds.

What Cryptocurrencies are Available?

NDAX supports a broad mix of major coins and popular altcoins. While not as extensive as global platforms, it offers enough variety for most Canadian traders and avoids questionable tokens that present unnecessary risk.

How Safe Is the Exchange?

NDAX employs institutional-grade security, including cold storage, advanced monitoring, and strict operational controls. It is Canadian-regulated and designed to meet local standards, giving users confidence in both custody and compliance.

#5 Wealthsimple – Best for beginners

What are the Pros & Cons?

Wealthsimple is easy for newcomers who want a single app for investing and crypto, though it lacks advanced tools and offers a smaller coin list.

✓ Pros

- Very simple

- Strong Canadian brand

- Easy CAD funding

✗ Cons

- Limited coins

- No advanced trading

Who Is Best For?

Wealthsimple suits new investors seeking a familiar interface and a simple entry into crypto. It's ideal for users who prefer low-maintenance investing and don't require broad coin selection or advanced trading features.

What are the Fees?

Wealthsimple charges a clear spread on crypto purchases, making pricing predictable but sometimes higher than trading-focused platforms. Its fee structure is designed for beginners who prioritise ease over optimised execution.

What Cryptocurrencies are Available?

Wealthsimple offers a curated selection of major cryptocurrencies, avoiding speculative or fringe assets. The list is intentionally small to maintain regulatory clarity, making it reliable for beginners who want straightforward choices.

How Safe Is the Exchange?

Wealthsimple meets Canadian regulatory standards and partners with qualified custodians for secure asset storage. It follows strong compliance practices, giving Canadians a safe environment backed by a well-known financial brand.

What is a Crypto Exchange?

A crypto exchange is a platform where Canadians can buy, sell, and trade digital assets using CAD or other cryptocurrencies. It acts as a marketplace connecting buyers and sellers, handling pricing, custody, and transaction processing through secure systems designed for retail and professional users.

What Are the Different Types of Cryptocurrency Exchanges?

Crypto exchanges fall into three main categories: centralized platforms, decentralized protocols, and brokers. Centralized exchanges manage custody and trading. Decentralized exchanges use automated protocols. Brokers simplify buying at set prices. Each offers different levels of control, complexity, and cost.

Is Crypto Exchange vs Crypto Broker?

A crypto exchange facilitates direct market trading between users, offering charts, order types, and liquidity. A broker simplifies purchasing by selling crypto at a set price. Exchanges suit active traders. Brokers appeal to beginners who prefer predictable quotes and fewer steps.

How Do I Choose the Right Crypto Exchange in Canada?

Choosing the right crypto exchange depends on your trading style, funding preferences, and risk tolerance. Look at fees, security history, CAD deposit options, and how many cryptocurrencies each platform offers. Consider whether you prefer a beginner interface or advanced trading tools. In practice, safety should come first.

What Security Features Should Canadian Crypto Exchanges Have?

A secure Canadian crypto exchange uses strong cold storage, robust authentication, and transparent operational controls. The best platforms include audits, proof-of-reserves checks, and strict identity verification. These protections reduce risk and ensure users can trade with cleaner oversight and peace of mind.

What Is Cold Storage and Why Does It Matter?

Cold storage keeps cryptocurrency offline, away from online threats and hacking attempts. Most trustworthy exchanges store the majority of client assets in cold wallets with restricted access. This reduces the risk of large-scale theft and protects long-term holdings from security breaches.

Are Canadian Crypto Assets Insured?

Some Canadian platforms use third-party custodians that carry insurance for digital assets held in cold storage. This coverage protects against specific custody breaches, though it typically does not insure losses from trading or user mistakes. Availability varies, so Canadians should confirm each exchange's policy.

What Are Proof-of-Reserves Audits?

Proof-of-reserves audits verify that an exchange holds enough assets to match customer balances. Independent auditors check wallet holdings and compare them with platform liabilities. These audits build trust, offering Canadians a clearer picture of whether the exchange operates responsibly.

How Much Do Canadian Crypto Exchanges Charge in Fees?

Canadian crypto fees differ based on whether an exchange uses spreads, maker-taker pricing, or fixed transaction rates. Some platforms charge for CAD withdrawals, while others keep funding nearly free. Low-fee traders often prefer Kraken or NDAX, while beginners lean toward Coinbase or Wealthsimple for simplicity.

| Exchange | Trading Fees | Min Deposit | CAD Deposit Fee | CAD Withdrawal Fee | Notes |

|---|---|---|---|---|---|

| Coinbase | Medium | No minimum | Low | Medium | Simple pricing |

| Kraken | Low | 10 CAD | Low | Low | Maker taker model |

| Bitbuy | Medium | No minimum | Low | Medium | Clear fees |

| NDAX | Very low | No minimum | Low | Low | Fixed low rate |

| Wealthsimple | Low | 1 CAD | Low | Low | Spread based |

Are There Provincial Restrictions on Crypto Trading in Canada?

Crypto trading is generally allowed across Canada, but some provinces have additional oversight requirements. Most restrictions relate to registration status and product availability, not overall access. Canadians should verify whether their chosen exchange complies with relevant provincial rules before opening an account.

Do Quebec and Ontario Have Different Crypto Rules?

Yes. Quebec and Ontario have unique securities regulations that may affect which exchanges can operate locally. Some platforms restrict features or availability in these provinces due to regulatory demands. Checking each exchange's provincial status ensures full access to offered services.

Can I Trade Crypto Anywhere in Canada?

Canadians can trade crypto nationwide as long as the exchange is authorised or registered to operate in their province. Certain platforms may limit services in specific regions, but major exchanges serving Canada typically support users nationwide with minimal restriction.

What Tax Obligations Come with Crypto Trading in Canada?

Crypto is treated as a taxable asset in Canada. Selling, trading, or converting crypto can trigger capital gains, while earning rewards or interest may count as income. Canadians must track their transactions carefully to ensure accurate reporting under CRA guidelines.

What Is Crypto Staking?

Crypto staking allows users to lock supported assets to help secure a blockchain network and earn rewards. Canadians participate through exchanges offering curated staking programs. Returns vary by asset and platform, and rewards may be taxable as income depending on their nature.

Which Exchanges Offer Staking in Canada?

Kraken, Crypto.com, and NDAX offer staking or earn-style rewards for selected cryptocurrencies, although availability can change as regulations evolve. Wealthsimple and Bitbuy provide limited or no staking options. Canadians should confirm each platform's active staking list before committing funds.

What Are Staking Rewards and How Are They Taxed?

Staking rewards are payouts received for supporting network operations. They are typically credited in the same cryptocurrency you stake. In Canada, these rewards are usually treated as taxable income upon receipt, with future gains becoming capital gains when assets are later sold.

How Do I Buy Crypto with Canadian Dollars?

Most Canadian exchanges allow easy CAD funding through Interac e-Transfer, bank transfer, or direct debit. After funding your account, you can choose a cryptocurrency, enter an amount, and complete the purchase. The process is designed to be intuitive and quick on major platforms.

What Payment Methods Do Canadian Exchanges Accept?

Common funding methods include Interac e-Transfer, bank wire, and occasionally debit card payments. Some platforms also allow crypto-to-crypto deposits. Payment availability varies, so Canadians should review which options each exchange supports before funding an account.

Is Interac e-Transfer Instant?

Interac e-Transfer is typically processed quickly, with many exchanges crediting funds within minutes. Some transfers may take longer depending on bank processing times or additional security checks. Overall, it remains Canada's fastest and most convenient funding method for crypto purchases.

Can I Use PayPal to Buy Crypto in Canada?

Most Canadian exchanges do not support PayPal for buying crypto due to chargeback risks. Some platforms may offer indirect PayPal funding routes, but availability is limited. Canadians usually rely on Interac or bank accounts for reliable CAD deposits.

Are There Fees for CAD Deposits?

CAD deposit fees depend on the exchange and funding method. Interac is often low cost or free, while bank wires may incur small charges. Checking each platform's funding page helps Canadians understand their total cost before transferring money.

How Long Do CAD Deposits Take?

Interac deposits typically arrive within minutes, while bank transfers can take several hours or more depending on the institution. Some platforms apply security holds for new accounts. Canadians usually experience quick funding across major exchanges.

Do I Need to Verify My Identity (KYC)?

Yes. Canadian regulations require identity verification before trading or withdrawing funds. Exchanges must collect personal information to meet anti-money-laundering rules. Completing KYC ensures full access to platform features and improves account security.

What Is KYC Verification?

KYC verification confirms your identity using government-issued documents and personal information. It helps exchanges meet regulatory obligations, reduce fraud, and protect users. Completing KYC is mandatory before accessing most trading and withdrawal features.

What Documents Do I Need?

Canadians typically need a passport, driver's licence, or provincial ID card, along with proof of address like a utility bill or bank statement. Some platforms may request a selfie check to validate your identity.

How Long Does Verification Take?

Verification is often completed within minutes using automated checks. In some cases, manual review may take longer, especially if documents are unclear. Most Canadians gain full account access quickly once required details are submitted.

Can I Buy Crypto Without KYC in Canada?

No. Canadian regulations require exchanges to verify user identity before enabling trading or withdrawals. Platforms must comply with FINTRAC rules, so anonymous or unverified accounts cannot be used to buy crypto in Canada.

How Do I Withdraw Money from a Canadian Crypto Exchange?

Withdrawing money from a Canadian exchange involves selling your cryptocurrency for CAD, selecting a withdrawal method, and completing the transfer to your bank. Interac e-Transfer is often the fastest option, while bank wires handle larger amounts. Withdrawals may include small fees depending on the platform.

What Cryptocurrencies Can I Buy in Canada?

Canadians can buy major cryptocurrencies like Bitcoin and Ethereum on all regulated exchanges. Altcoin availability varies by platform, with international exchanges offering wider selections. Local platforms curate their lists to maintain regulatory clarity and reduce risk for new users.

Do All Exchanges Offer Bitcoin and Ethereum?

Yes. Every Canadian exchange supports Bitcoin and Ethereum, as they are the most widely traded cryptocurrencies. These assets remain accessible across all platforms regardless of trading level or experience.

Which Exchange Has the Most Altcoins?

Kraken and Crypto.com typically offer the broadest range of altcoins accessible to Canadians. Their listings include established projects and selected emerging assets, while maintaining regulatory alignment and avoiding high-risk speculative tokens.

Can I Buy Stablecoins in Canada?

Stablecoin availability varies due to evolving regulations. USDC is commonly supported, while USDT access may change depending on platform policies. Canadians should confirm stablecoin availability on their chosen exchange before funding.

What Are the Most Popular Cryptos to Buy in Canada?

Bitcoin, Ethereum, and established altcoins like Solana and Litecoin remain popular among Canadians. Interest also grows around staking-enabled assets such as Polkadot and Cardano on platforms that support them.

Should I Use a Centralized or Decentralized Exchange?

Centralized exchanges offer easier onboarding, stronger oversight, and simpler CAD funding. Decentralized exchanges provide self-custody and broader asset access but require more technical knowledge. Most Canadians start with centralized platforms for convenience before exploring decentralized alternatives.

Best Crypto Exchange Canada by Trading Level

Best Exchange for Beginners – Wealthsimple & Coinbase

Both platforms offer simple interfaces, clear pricing, and strong Canadian support. They focus on ease of use rather than advanced features.

Best Exchange for Active Traders – Kraken & NDAX

These platforms provide low fees, deep liquidity, and robust trading tools suited to frequent or high-volume users.

Best Exchange for Day Trading – Kraken

Kraken's liquidity, order types, and tight spreads make it a strong option for short-term trading strategies.

Best Exchange for Long-Term Investors – Wealthsimple

Wealthsimple caters to long-term investors who prefer a clean interface, stable pricing, and broad financial services beyond crypto.

Author Summary

I've tested and compared each Canadian crypto exchange using real fees, funding limits, and security features. My goal is to help Canadians choose a platform that fits their needs, whether they value low fees, simplicity, or strict regulation. The best exchange depends on your experience and priorities.

Conclusion: Which Exchange Should I Choose?

For most Canadians, Coinbase or Wealthsimple offer the easiest entry into crypto. Active traders may prefer Kraken or NDAX for lower fees and stronger tools. Those who want full domestic regulation often choose Bitbuy. The right platform depends on your goals and trading style.

Explore More Trading Topics

Top Rankings

Buying Guides

Frequently Asked Questions

Common questions about crypto exchanges in Canada, covering trust, legality, fees, and platform choices.

What is the most trusted crypto exchange in Canada?

Coinbase and Kraken are among the most trusted due to strong security, long operating histories, and transparent compliance.

Is crypto trading legal in Canada?

Yes. Canadians can buy and sell crypto legally through regulated exchanges meeting national and provincial rules.

Can I use Coinbase in Canada?

Yes. Coinbase supports Canadian users with CAD funding and full access to its core features.

Which crypto exchange has the lowest fees in Canada?

Kraken and NDAX consistently offer the lowest trading fees for Canadians.

Do I need a wallet if I use an exchange?

Exchanges provide built-in wallets, but many Canadians move long-term holdings to private wallets for greater control.

Can I buy crypto with a credit card in Canada?

Some platforms support credit card purchases, though fees can be higher. Most Canadians use Interac for lower costs.