Best Crypto Wallets in the UK for 2025

Jerry Dennis

Founder & Lead Blockchain StrategistJerry Dennis is a visionary founder bridging traditional technology and decentralized finance. With over 15 years in software development and SaaS innovation, he brings deep expertise in creating scalable blockchain solutions and crypto-investment strategies. His passion lies in demystifying complex concepts and making advanced technology accessible.

View full author profile →

Samantha Lee

Co-founder & Chief Technology OfficerCo-founding Best3iGaming alongside Jerry, Samantha Lee serves as the architect of the platform's security infrastructure. Her expertise in software engineering and cybersecurity ensures every digital transaction is handled with maximum safety and efficiency. She believes the future of decentralized technology must be inherently trustworthy and secure.

View full author profile →

Markus Webb

Head of Research & DevelopmentMarkus Webb brings over a decade of experience in blockchain technology and digital currency research. He specializes in turning complex cryptographic concepts into practical financial solutions. His work focuses on analyzing blockchain applications and understanding the implications of cryptocurrency investments for the future of economic systems.

View full author profile →Marcus Whitfield

Chief Editor, Best 3 iGamesMarcus Whitfield is a financial technology analyst and iGaming specialist with over 8 years of experience covering online trading platforms, cryptocurrency exchanges, and regulated gambling markets. After beginning his career in compliance consulting for UK fintech startups, Marcus transitioned to financial journalism, focusing on helping everyday investors navigate complex platforms.

He holds a certificate in Financial Services Regulation from the Chartered Institute for Securities & Investment (CISI) and has contributed research to publications covering emerging markets and digital assets. When not analysing broker fee structures, Marcus can be found testing new trading apps or following Premier League football.

He has worked with iGaming operators across multiple jurisdictions on licensing requirements, anti-money laundering protocols, and the implementation of provably fair gaming systems. His particular focus is on helping platforms navigate the complex regulatory landscape where cryptocurrency and online gambling intersect.

Douglas Harbury

Blockchain Strategist & iGaming Compliance ConsultantDouglas Harbury is a blockchain strategist and iGaming compliance consultant with over 18 years of experience across digital payments, cryptocurrency infrastructure, and regulated online gambling markets. After spending the early part of his career in payment processing and financial operations, Douglas moved into emerging financial technologies in 2011, advising cryptocurrency exchanges and digital asset platforms on regulatory frameworks and operational security.

He has worked with iGaming operators across multiple jurisdictions on licensing requirements, anti-money laundering protocols, and the implementation of provably fair gaming systems. His particular focus is on helping platforms navigate the complex regulatory landscape where cryptocurrency and online gambling intersect.

View full author profile →How We Test & Review

At Best3iGaming, we maintain rigorous standards for all blockchain and cryptocurrency content through comprehensive testing and verification. We do not accept payment in exchange for positive reviews.

- Direct Testing: We open real accounts, deposit real funds, and play games to test the user experience.

- Withdrawal Verification: We test withdrawal speeds and KYC requirements personally.

- On-Chain Verification: We cross-reference transaction claims with blockchain explorers.

- Expert Review: All content is reviewed by experienced blockchain professionals before publication.

- All claims backed by multiple authoritative sources.

- Clear disclosure of any affiliate relationships.

- Independence maintained in all editorial decisions.

Report inaccuracies: contact@best3igaming.io

Best B3i Gaming Disclaimer

Best B3i Gaming is an affiliate website. We may receive commission from casinos, gambling platforms, and other services featured on this site when you click through our links and register or deposit. This comes at no additional cost to you.

Our affiliate relationships may influence which platforms we review, how they are rated, and where they appear on our site. However, we strive to provide honest, balanced assessments to help you make informed decisions.

You are solely responsible for conducting your own due diligence before using any platform, service, or product featured on this site. This includes, but is not limited to:

- Verifying that online gambling is legal in your country, state, territory, or region.

- Confirming that any platform you access is licensed to operate in your jurisdiction.

- Understanding the terms, conditions, and risks associated with any platform before registering or depositing.

- Ensuring compliance with all applicable local, national, and international laws.

- Assessing your own financial situation and risk tolerance before gambling or using cryptocurrency.

Best B3i Gaming does not and cannot verify your location, age, or legal eligibility to gamble.

We do not endorse, guarantee, or verify the licensing status, legitimacy, security, or fairness of any platform featured on this site. You must independently verify a platform's regulatory status and reputation before use.

A platform's inclusion on this site does not constitute a recommendation that it is legal, safe, or appropriate for you.

Nothing on Best B3i Gaming constitutes financial, investment, legal, or tax advice. We are not licensed financial advisors, solicitors, or tax professionals.

Cryptocurrency values are highly volatile; you may lose some or all of your funds. Any information regarding cryptocurrencies, tokens, or digital assets is for informational and entertainment purposes only.

Gambling involves significant risk. You may lose more than you deposit. Only gamble with money you can afford to lose.

Past results, promotional offers, and theoretical return-to-player (RTP) percentages do not guarantee future outcomes. Casino games and betting products are designed to favour the operator over time. There is no guaranteed strategy for profit.

Gambling should be entertainment, not a source of income or a way to recover losses. If you or someone you know is struggling with problem gambling, please seek help from a recognised support organisation in your region:

- BeGambleAware (UK): begambleaware.org

- GamCare (UK): gamcare.org.uk

- Gambling Therapy (Int): gamblingtherapy.org

- NCPG (USA): ncpgambling.org

- Gambling Help Online (Aus): gamblinghelponline.org.au

You must meet the minimum legal gambling age in your jurisdiction to use gambling services. This is typically 18 or 21 years of age depending on location.

By using this site, you confirm that you meet the legal age requirement where you reside. It is your responsibility to know and comply with age restrictions in your area.

Information on Best B3i Gaming is provided "as is". We do not warrant that any information is accurate, complete, current, or error-free.

Platform terms, bonus offers, wagering requirements, accepted cryptocurrencies, withdrawal limits, licensing status, and features may change at any time without notice. Always verify current terms directly with the platform before participating.

To the fullest extent permitted by applicable law, Best B3i Gaming, its owners, operators, employees, contractors, and affiliates accept no liability whatsoever for any loss, damage, cost, or harm arising from:

- Your use of this website.

- Reliance on information provided here.

- Use of third-party platforms.

- Any decision made based on this content.

- Gambling or crypto losses.

- Legal consequences of your activities.

Indemnification: By using this site, you agree to indemnify and hold harmless Best B3i Gaming and its affiliates from any claims arising from your use of this site or third-party platforms.

Third-Party Links: We have no control over third-party websites. Accessing external links is entirely at your own risk. Changes: We reserve the right to update or modify this disclaimer at any time without prior notice.

Choosing the right crypto wallet in the UK requires balancing security with accessibility. Whether you need FCA-regulated protection or cold storage for long-term holdings, this guide covers the top 7 wallets tested for UK users—from beginner-friendly options to advanced hardware solutions for serious investors.

What’s the Best UK Crypto Wallet Right Now?

eToro Money Wallet ranks as the best overall choice for UK users due to its FCA registration and seamless integration with trading platforms. For maximum security, Trezor Model T and Ledger Nano S Plus provide offline cold storage. Beginners benefit from eToro’s custodial safety, while experienced holders prefer hardware wallets for complete control.

These wallets represent the strongest options across hot and cold storage categories. eToro leads for regulatory compliance and ease of use, making it ideal for first-time investors. Trezor and Ledger dominate the cold wallet space with proven security records and broad cryptocurrency support. MetaMask serves DeFi users needing Web3 access, while Coinbase Wallet and Trust Wallet offer non-custodial alternatives. Ledger Nano X adds Bluetooth connectivity for mobile users who want cold storage convenience.

Top 7 Crypto Wallets for UK Users: Quick Comparison

| Rank | Wallet Name | Type | Cost | Coins Supported | Security Rating | Mobile Support | Best For |

|---|---|---|---|---|---|---|---|

| 1 | eToro Money Wallet | Hot | Free | 120+ |

★

★

★

★

★ | ✓ | Beginners & UK traders |

| 2 | Trezor Model T | Cold | £200-£220 | 1500+ |

★

★

★

★

★ | ✗ | Long-term security |

| 3 | Ledger Nano S Plus | Cold | £70-£90 | 5500+ |

★

★

★

★

★ | ✗ | Budget cold storage |

| 4 | Coinbase Wallet | Hot | Free | 100+ |

★

★

★

★

★ | ✓ | Multi-currency support |

| 5 | MetaMask | Hot | Free | EVM chains |

★

★

★

★

★ | ✓ | DeFi & Web3 users |

| 6 | Ledger Nano X | Cold | £120-£140 | 5500+ |

★

★

★

★

★ | ✓ | Mobile + cold storage |

| 7 | Trust Wallet | Hot | Free | 100+ |

★

★

★

★

★ | ✓ | Free mobile wallet |

Here’s the Top 7 Crypto Wallets in the UK:

- eToro Money Wallet – Best for Beginners

FCA-regulated wallet integrating with eToro’s trading platform, ideal for first-time investors managing / buying crypto alongside stocks and ETFs. - Trezor Model T – Best for Long-Term Security

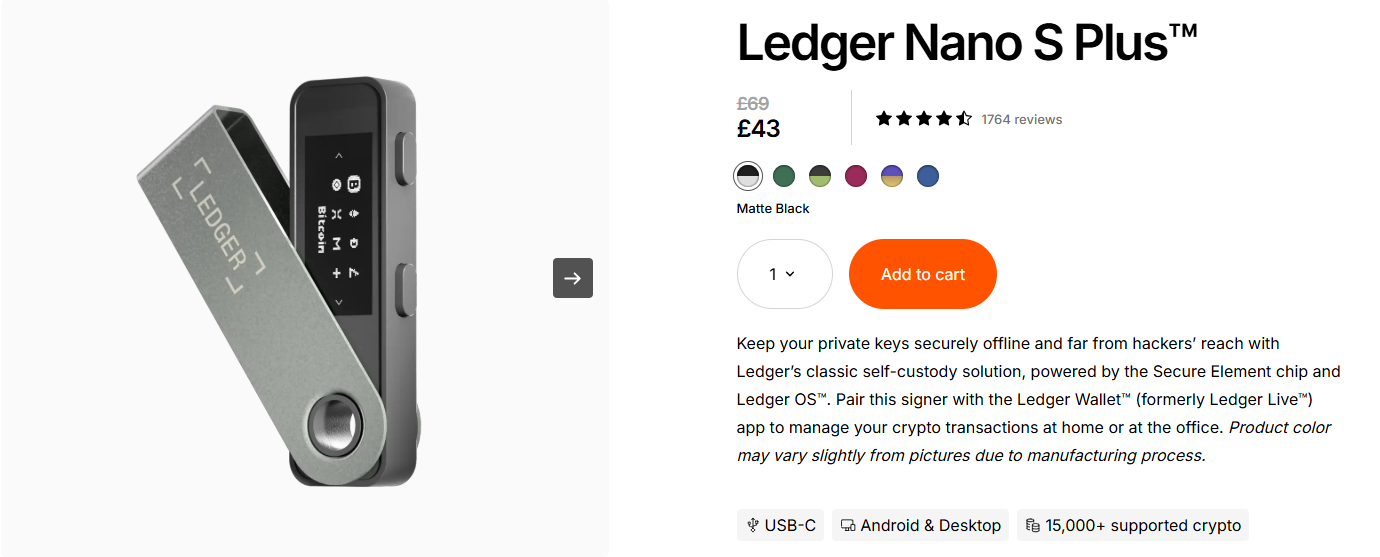

Open-source hardware wallet with touchscreen verification and Shamir Backup, supporting 1,800+ cryptocurrencies for maximum cold storage protection. - Ledger Nano S Plus – Best Budget Cold Wallet

Affordable hardware security supporting 5,500+ tokens with certified secure chip—perfect for cost-conscious long-term holders. - Coinbase Wallet – Best for Multi-Currency Support

Non-custodial wallet offering complete private key control with seamless Coinbase exchange integration and built-in dApp browser. - MetaMask – Best for Ethereum & DeFi

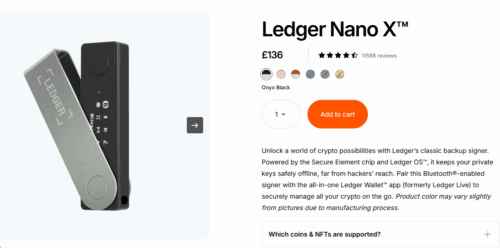

Essential Web3 wallet connecting to decentralized applications across multiple EVM-compatible blockchains with hardware wallet integration. - Ledger Nano X – Best Mobile-Compatible Cold Wallet

Premium hardware wallet with Bluetooth connectivity enabling secure mobile portfolio management for active investors on the move. - Trust Wallet – Best Free Mobile Wallet

Completely free non-custodial wallet supporting 100+ blockchains with built-in staking and dApp browser—ideal for mobile-first users.

eToro Money Wallet – Best FCA-Regulated Wallet for Beginners

Pros

- FCA-registered providing UK regulatory protection

- Seamless integration with eToro trading platform

- Two-factor authentication and cold storage security

- Supports 120+ cryptocurrencies including Bitcoin and Ethereum

- Internal transfers within eToro are free

Cons

- Custodial wallet meaning eToro controls your private keys

- Higher withdrawal fees compared to non-custodial options

- Only available to existing eToro account holders

Fees & Costs

Free wallet with no setup charges. Withdrawal fee of £5 applies when moving crypto to external wallets. Network blockchain fees still apply.

Security & FCA Compliance

FCA-registered provider with mandatory two-factor authentication. Cold storage protects majority of user funds. Custodial model means eToro holds private keys with institutional security protocols.

Trezor Model T – Best Cold Wallet for Long-Term Storage

Pros

- Completely offline cold storage eliminates online hack risks

- Touchscreen interface for easier transaction verification

- Open-source firmware with regular security audits

- Shamir Backup for advanced recovery seed protection

- Supports 1,800+ cryptocurrencies

Cons

- Higher initial cost at £200-£220

- No Bluetooth connectivity requiring USB connection

- Learning curve for first-time hardware wallet users

Fees & Costs

One-time purchase of £200-£220 with no recurring fees. Network transaction fees apply when sending crypto but are determined by blockchain not Trezor.

Security Features

PIN protection with brute-force attempt blocking. Offline private key storage with touchscreen transaction verification. Optional passphrase adds extra security layer beyond recovery seed.

Ledger Nano S Plus – Best Budget Cold Wallet

Pros

- Affordable hardware wallet at £70-£90

- Certified secure element chip with bank-grade encryption

- Supports 5,500+ cryptocurrencies and NFTs

- Larger screen than previous Nano S model

- Regular firmware updates from Ledger

Cons

- No Bluetooth connectivity requiring cable connection

- Limited app storage space on device

- Must be connected to computer or phone to operate

Fees & Costs

One-time purchase price of £70-£90. No subscription or maintenance fees. Users pay only standard blockchain network fees when transacting.

Security Features

CC EAL5+ certified secure element chip guards against physical attacks. PIN code required for device access. 24-word recovery phrase stored offline only.

Coinbase Wallet – Best for Multi-Currency Support

Pros

- Non-custodial giving you complete private key control

- Supports 100+ cryptocurrencies including Bitcoin and Ethereum

- Direct integration with Coinbase exchange for easy transfers

- Biometric authentication on mobile devices

- Built-in dApp browser and NFT support

Cons

- Not FCA-regulated unlike Coinbase exchange

- High Ethereum gas fees during network congestion

- No direct GBP deposit functionality

Fees & Costs

Free to download and use. Network transaction fees apply based on blockchain congestion. In-wallet swaps include spread markup above standard exchange rates.

Security Features

Non-custodial with user-controlled private keys. AES-256 encryption for stored data. Biometric login available on iOS and Android. Vulnerable to phishing if users access fake websites.

MetaMask – Best for Ethereum & DeFi

Pros

- Seamless connection to DeFi protocols and dApps

- Supports multiple EVM-compatible blockchains

- Hardware wallet integration with Ledger and Trezor

- Open-source code with community audits

- Free browser extension and mobile app

Cons

- No Bitcoin or non-EVM blockchain support

- High phishing attack risk from fake websites

- Ethereum gas fees can be expensive

- Steeper learning curve for beginners

Fees & Costs

Free wallet with no download or setup costs. MetaMask adds 0.875% fee on token swaps. Ethereum gas fees vary widely based on network congestion.

Security Features

Private keys stored locally on device. Password and optional biometric protection. Hardware wallet compatibility for enhanced security. Users must verify website authenticity to avoid phishing.

Ledger Nano X – Best Mobile-Compatible Cold Wallet

Pros

- Bluetooth connectivity for mobile device compatibility

- Rechargeable battery for wireless operation

- Supports 5,500+ cryptocurrencies and tokens

- Larger app storage capacity than Nano S Plus

- Works with Ledger Live on desktop and mobile

Cons

- Higher cost at £120-£140

- Battery requires periodic charging

- Bluetooth adds minimal attack surface risk

Fees & Costs

One-time purchase of £120-£140. No recurring fees or subscriptions. Standard blockchain network fees apply when sending transactions.

Security Features

CC EAL5+ certified secure element chip. Bluetooth encryption protects wireless connections. PIN code and optional passphrase security. Private keys never leave device even when using Bluetooth.

Trust Wallet – Best Free Mobile Wallet

Pros

- Completely free with no hidden fees

- Supports 100+ blockchains and millions of tokens

- Built-in staking for passive income

- Integrated dApp browser and DEX access

- Non-custodial with user-controlled keys

Cons

- Mobile-only with limited desktop functionality

- Owned by Binance raising centralization concerns

- Customer support can be slow

- Higher risk for mobile device theft or loss

Fees & Costs

Free download and use with no wallet fees. Network transaction fees vary by blockchain. In-app token swaps charge minimal spread fees.

Security Features

Non-custodial with encrypted private key storage. Biometric authentication on compatible devices. 12-word recovery phrase backup. Users responsible for device security and phishing awareness.

Hot Wallets vs Cold Wallets: Which Should You Choose?

Hot wallets stay connected to the internet providing instant access for trading and transactions, making them ideal for active users who need frequent liquidity. Cold wallets store private keys completely offline on hardware devices, eliminating online hack risks but requiring physical device access for every transaction.

UK investors holding under £5,000 often prefer hot wallets for convenience, while those with larger holdings typically split assets between hot wallets for daily use and cold wallets for long-term storage. Security-conscious users adopt a hybrid approach keeping 10-20% in hot wallets and 80-90% in cold storage, balancing accessibility with protection against exchange hacks and phishing attacks.

Hot Wallet Pros & Cons

Hot wallets excel at providing immediate access to funds for trading, purchasing, and transferring cryptocurrencies without hardware device requirements. Free options like MetaMask and Trust Wallet eliminate upfront costs while supporting multiple blockchains and DeFi protocols. However, constant internet connectivity exposes users to hacking, phishing, and malware risks that have resulted in millions of pounds lost annually across the UK crypto community.

Hot Wallet Advantages

- Instant access for trading and transactions

- Free to use with no hardware purchase required

- Easy setup taking minutes not hours

- Perfect for DeFi and dApp interaction

- Mobile and desktop accessibility

Hot Wallet Disadvantages

- Higher vulnerability to hacking and phishing

- Reliance on device security and antivirus protection

- Exchange custody risks for custodial wallets

- Recovery phrase compromise if stored digitally

- Less suitable for large long-term holdings

Cold Wallet Pros & Cons

Cold wallets provide maximum security through offline private key storage on dedicated hardware devices immune to remote hacking attempts. Physical possession requirements and transaction verification on device screens protect against unauthorized access even if computers become compromised. The upfront cost and slower transaction process create friction for frequent traders, but long-term holders benefit from peace of mind knowing their assets remain protected from the vast majority of crypto theft methods.

Cold Wallet Advantages

- Maximum security with offline key storage

- Protection from remote hacking and malware

- Physical transaction verification on device

- Suitable for large holdings and long-term storage

- Recovery possible even if device is lost

Cold Wallet Disadvantages

- Upfront cost of £70-£220 for hardware

- Slower transaction process requiring device connection

- Risk of physical loss or damage

- Less convenient for frequent trading

- Learning curve for first-time users

How to Choose the Right Crypto Wallet in the UK

Selecting the right crypto wallet depends on your investment size, trading frequency, technical knowledge, and security priorities.

UK investors holding under £1,000 typically choose free hot wallets like Coinbase Wallet or Trust Wallet for convenience, while those with £5,000+ investments should consider hardware wallets like Ledger or Trezor for enhanced security.

FCA registration matters for beginners seeking regulatory protection through platforms like eToro, whereas experienced users often prioritize non-custodial control. For more info see our full etoro review.

Consider your primary use case whether daily DeFi trading requiring MetaMask, long-term Bitcoin storage needing cold wallets, or multi-asset portfolios benefiting from Ledger’s broad support.

Match wallet features to your technical comfort level and always verify FCA status if regulatory protection influences your decision.

Security Features That Matter

Two-factor authentication should be non-negotiable for any wallet protecting significant value, adding extra verification beyond passwords through SMS codes or authenticator apps.

Hardware wallet users benefit from PIN protection and physical transaction verification preventing unauthorized access even if recovery phrases become compromised. Biometric authentication through fingerprint or face recognition streamlines access on mobile devices while maintaining security standards above simple passwords.

FCA Regulation & Why It Matters

FCA registration means crypto providers comply with UK anti-money laundering regulations and maintain specific operational standards, though it does not provide Financial Services Compensation Scheme protection.

eToro Money Wallet currently holds FCA registration making it the only reviewed wallet with UK regulatory oversight. Non-regulated wallets like Ledger and MetaMask operate legally but without FCA supervision, placing full security responsibility on users to protect their private keys and recovery phrases.

Setting Up & Using Your Crypto Wallet

Crypto wallet setup requires downloading software or purchasing hardware, creating secure passwords, and safely storing recovery phrases offline. The process takes 10-30 minutes depending on wallet type, with hot wallets offering faster setup through mobile apps and cold wallets requiring additional firmware installation and device initialization steps.

Step-by-Step Setup Guide

- Download your chosen wallet from official sources only, verifying URLs match legitimate provider websites to avoid phishing scams

- Create a strong password combining uppercase, lowercase, numbers, and symbols exceeding 12 characters minimum

- Write down your 12-24 word recovery phrase on paper never storing it digitally or photographing it

- Enable two-factor authentication immediately after account creation

- For hardware wallets, install the companion app like Ledger Live or Trezor Suite before connecting devices

- Verify device authenticity through holographic seals and tamper-evident packaging before first use

- Complete initial wallet funding with a small test transaction to confirm everything works correctly

How to Send & Receive Crypto Safely

Receiving Cryptocurrency:

- Open your wallet and navigate to the receive section

- Select the specific cryptocurrency you want to receive

- Copy your wallet address or display the QR code

- Share only the public address never your private keys or recovery phrase

- Wait for blockchain confirmation which takes 10-60 minutes depending on network

Sending Cryptocurrency:

- Click send or transfer within your wallet interface

- Enter or paste the recipient’s wallet address carefully

- Double-check every character of the address as transactions cannot be reversed

- Enter the amount you wish to send

- Review network fees and adjust priority if needed

- Send a small test amount first when using new addresses

- Confirm the transaction and wait for blockchain verification

Crypto Wallet Security Best Practices

Crypto security depends entirely on protecting private keys and recovery phrases since blockchain transactions offer no chargeback protection or fraud reversal. UK users lose millions annually to phishing scams, fake apps, and compromised devices making security protocols essential for any holding size. Following established best practices reduces theft risk by over 95% according to blockchain security researchers.

Protecting Your Recovery Phrase

Write recovery phrases on paper or metal plates never storing them in cloud services, password managers, or digital photos

- Store physical copies in multiple secure locations like home safes and bank deposit boxes

- Never share recovery phrases with anyone including customer support representatives

- Consider splitting phrases across locations for high-value holdings using Shamir Backup on compatible hardware wallets

- Test your recovery phrase backup by restoring a wallet before funding it with significant amounts

- Keep copies in fireproof and waterproof containers for physical disaster protection.

Avoiding Phishing & Scams

- Verify wallet website URLs before downloading software checking for exact domain spelling

- Only download wallet apps from official Apple App Store or Google Play Store

- Check developer names match wallet providers exactly before installing

- Ignore unsolicited messages offering wallet support or promising cryptocurrency returns

- Enable address whitelisting on exchanges allowing withdrawals only to pre-approved addresses

- Never click links in emails claiming to be from wallet providers

- Bookmark official wallet websites to avoid typing URLs that could lead to phishing sites

- Use hardware wallets for large holdings as they require physical confirmation for transactions

UK Tax & Regulatory Considerations

HMRC treats cryptocurrency as property subject to capital gains tax when sold, traded, or used for purchases above annual allowances. UK crypto investors must maintain detailed records of all transactions including dates, amounts, and GBP values at transaction time for accurate tax reporting.

HMRC Capital Gains Tax on Crypto

Capital gains tax applies when disposing of cryptocurrency through sales, trades, or spending with rates of 10% for basic rate taxpayers and 20% for higher rate taxpayers on gains exceeding £3,000 annual allowance for 2024/25 tax year. Each cryptocurrency disposal creates a taxable event requiring calculation of gain or loss based on GBP value at acquisition versus disposal. HMRC requires reporting crypto gains on self-assessment tax returns even if gains fall below the £3,000 threshold when total proceeds exceed £15,000 annually.

Final Verdict: Which Wallet Should You Choose?

UK beginners should start with eToro Money Wallet for FCA-regulated security and ease of use when holding under £5,000. Investors with £5,000-£50,000 need hardware wallets like Ledger Nano S Plus for budget-conscious security or Ledger Nano X for mobile convenience. Serious holders with £50,000+ should use Trezor Model T with Shamir Backup and consider multi-signature wallets for additional protection. DeFi users require MetaMask for Web3 access regardless of other wallet choices. The optimal strategy combines hot wallets for 10-20% of holdings for trading and cold wallets for 80-90% long-term storage.

Trade Smarter

Access 3,000+ cryptocurrencies

0%

Trading Fees

40M+

Active Users

3,000+

Cryptocurrencies

170+

Countries

Crypto trading involves risk. Not available in all regions.

FAQs

Do I need a wallet to buy Bitcoin?

You can buy Bitcoin through some of the top crypto exchanges like eToro or Coinbase without a separate wallet

Are crypto wallets legal in the UK?

Yes, crypto wallets are completely legal in the UK. The FCA regulates providers for anti-money laundering compliance. UK residents must report crypto gains exceeding £3,000 annually to HMRC for capital gains tax purposes.

What's the safest crypto wallet?

Hardware wallets like Trezor Model T and Ledger Nano S Plus offer maximum security through offline storage. For regulatory protection, eToro Money Wallet provides FCA registration. Cold wallets eliminate online hacking risks entirely.

What if I lose my recovery phrase?

Losing your recovery phrase means permanent loss of wallet access and funds. No company can recover cryptocurrencies without it. Always store multiple copies in secure physical locations like safes or deposit boxes.

How much do crypto wallets cost?

Software wallets like MetaMask and Trust Wallet are free. Hardware wallets cost £70-£90 for Ledger Nano S Plus or £200-£220 for Trezor Model T. All wallets charge blockchain network transaction fees.

References

Financial Conduct Authority (FCA) – Cryptoasset firms register

HM Revenue & Customs – Cryptoassets Manual

eToro – Security & Regulation Information

Trezor – Security Best Practices

Ledger – Supported Cryptocurrencies List

MetaMask – Security Documentation

Coinbase – Wallet Security Features

Trust Wallet – Multi-Chain Support

HM Revenue & Customs – Capital Gains Tax rates and allowances

Financial Conduct Authority – Consumer Warning on Cryptoassets